Immigrating to Canada is an exciting journey filled with new opportunities and experiences. However, one critical aspect that often poses challenges for newcomers is establishing a credit history in their new home. A robust credit history is essential in Canada, as it influences your ability to secure loans, rent accommodations, and even obtain certain jobs.

Related article: The Wonder Bank Fuelling Economic Growth and Empowering Communities

Related article: Nomad Chronicles: Unveiling the Triumphs and Trials of Digital Wanderers – From Liberation to Levies

This comprehensive guide will explore the nuances, showing you how to transfer your credit rating when you immigrate to Canada as well as laying the blueprints on how to build your credit score when you get across the border, providing actionable steps to help you establish a solid financial foundation.

Understanding Credit Scores in Canada

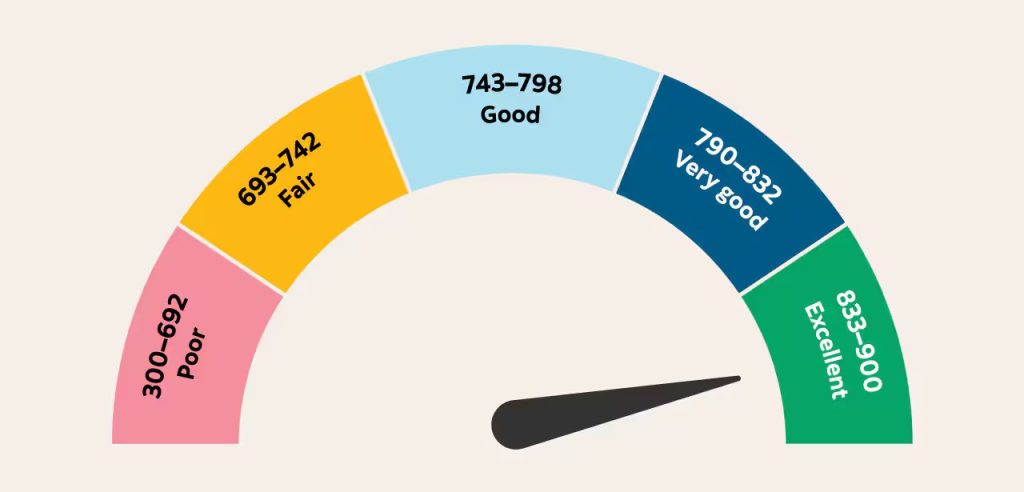

In Canada, credit scores range from 300 to 900, with higher scores indicating better creditworthiness. These scores are calculated based on various factors, including payment history, credit utilization, length of credit history, types of credit used, and recent credit inquiries. The primary credit bureaus in Canada are Equifax and TransUnion, which collect and maintain credit information to generate these scores.

Do International Credit Histories Transfer When You Immigrate To Canada?

One of the most common questions among newcomers is whether their existing credit history from their home country can be transferred when they immigrate to Canada. Unfortunately, credit histories are not typically transferable across international borders. Each country has its own credit reporting systems and regulations, meaning your previous credit history may not be recognized in Canada. As a result, immigrants often need to build their Canadian credit history from scratch.

Emerging Solutions: Equifax’s Global Consumer Credit File

Recognizing the challenges faced by newcomers, Equifax Inc. has launched the Global Consumer Credit File program. This initiative allows immigrants to transfer their foreign credit history to Canada, facilitating easier access to services like loans and cell phone plans by providing additional data to Canadian lenders. This program represents a significant step toward bridging the gap for newcomers seeking to establish credit in Canada.

Steps to Build Your Credit History When You Immigrate To Canada

While transferring your existing credit history may not always be possible, there are several effective strategies to build a strong credit profile in Canada:

- Obtain a Social Insurance Number (SIN): A SIN is essential for working in Canada and accessing government programs. It’s also required to open many types of bank accounts, especially credit accounts. You can apply for one online or at a Service Canada Centre.

- Open a Canadian Bank Account: Establishing a relationship with a Canadian financial institution is a crucial first step. Many banks offer newcomer packages that include benefits like fee waivers and favorable terms. Having a bank account also sets the stage for accessing other financial products.

- Apply for a Canadian Credit Card: Using a credit card responsibly is one of the fastest ways to build a credit score. Some banks offer credit cards specifically designed for newcomers without a Canadian credit history. If you don’t qualify for an unsecured card, consider a secured credit card, which requires a security deposit and can help establish your creditworthiness.

- Use Credit Responsibly: Make small, regular purchases with your credit card and pay off the balance in full each month. This demonstrates responsible credit usage and positively impacts your credit score. Aim to keep your credit utilization ratio—the percentage of your credit limit that you’re using—below 35%.

- Consider Alternative Credit Building Tools: Some programs allow you to report rent payments to credit bureaus, helping to build your credit history. For instance, the Landlord Credit Bureau enables tenants to have their rent payment history reported to Equifax, which can enhance their credit profiles.

- Monitor Your Credit Report: Regularly check your credit report for errors or discrepancies. When you immigrate to Canada, you’re entitled to a free copy of your credit report from each of the major credit bureaus once a year. Monitoring your report helps you stay informed about your credit status and identify areas for improvement.

Leveraging Existing Relationships with Financial Institutions

If you have relationships with international banks that operate in Canada, such as HSBC or American Express, inquire whether they can consider your foreign credit history or assist in establishing credit when you immigrate to Canada. For example, American Express may consider your history with their U.S. cards if you apply for a Canadian card.

Understanding the Importance of Credit in Canada

A good credit score in Canada can significantly impact various aspects of your life, including:

- Loan Approvals: Lenders assess your credit score to determine your eligibility for personal loans, mortgages, and lines of credit.

- Rental Applications: Landlords may check your credit history to evaluate your reliability as a tenant.

- Employment Opportunities: Some employers conduct credit checks as part of their hiring process, especially for roles that involve financial responsibilities.

- Utility Services: Utility providers might review your credit history before setting up services or determining if a deposit is required.

Common Myths About Credit Scores for Newcomers

There are several misconceptions about credit scores that newcomers should be aware of:

- Myth: Checking your own credit report will lower your score.

- Fact: Requesting your own credit report is considered a soft inquiry and does not affect your credit score.

- Myth: You start with a high credit score that decreases with credit usage.

- Fact: Newcomers start with no credit score, and it builds over time with responsible credit usage.

- Myth: Income level directly affects your credit score.

- Fact: Your income level does not directly affect your credit score. However, lenders may consider your income along with your credit score when assessing your ability to repay loans or credit obligations.

Building Credit Through Non-Traditional Channels

For newcomers who may struggle to qualify for credit cards or loans initially, alternative methods can help establish creditworthiness:

- Apply for a Secured Credit Card:

A secured credit card requires a deposit, which serves as collateral and typically equals your credit limit. For instance, if you deposit $500, your credit limit will be $500. By using the card responsibly and paying your bills on time, you can build your credit history. - Use a Co-Signer:

If you have a trusted friend or family member with good credit in Canada, they can co-sign a loan or credit application. This provides reassurance to lenders and helps you build your credit, as long as payments are made responsibly. - Become an Authorized User:

Being added as an authorized user on someone else’s credit card can help you establish credit. The primary cardholder’s good payment habits can reflect positively on your credit report, but be sure to choose someone responsible with their credit. - Pay Bills on Time:

While utility payments typically don’t appear on credit reports, some third-party services allow you to report your rent or utility payments to credit bureaus. Consistently paying these bills on time demonstrates financial responsibility.

- Apply for a Secured Credit Card:

Steps for Long-Term Credit Health

Once you’ve established your credit history after you immigrate to Canada, it’s important to maintain and improve it. Here’s how:

- Avoid Overborrowing:

Taking on more credit than you can handle can lead to missed payments and high credit utilization, which harm your credit score. - Set Up Automatic Payments:

Ensure you never miss a payment by setting up automatic payments for your credit cards, loans, and bills. - Keep Credit Accounts Open:

Even if you stop using a credit card, keeping the account open (as long as it doesn’t have annual fees) can positively impact the length of your credit history and overall score. - Diversify Your Credit Mix:

Over time, using different types of credit, such as credit cards, auto loans, or lines of credit, demonstrates your ability to manage various financial products effectively. - Limit Hard Inquiries:

Each time you apply for credit, a hard inquiry is made on your report, which can temporarily lower your score. Apply for credit only when necessary.

Government Programs and Newcomer Support

The Canadian government and financial institutions offer resources to help newcomers navigate their financial journey. These include:

- Immigrant Services: Many non-profit organizations provide financial literacy workshops for newcomers to learn about credit scores and responsible money management.

- Financial Institution Programs: Banks like RBC, CIBC, and TD offer tailored packages for newcomers, which often include credit-building tools and low-fee accounts. For instance, some banks provide unsecured credit cards to newcomers based on employment status rather than credit history.

- Settlement Agencies: These agencies, such as the YMCA’s Newcomer Information Centre or Immigrant Services Calgary, can guide you in managing finances and building credit.

The Role of Education in Credit Success

Understanding how the Canadian credit system works is crucial to achieving long-term financial stability. Financial literacy programs tailored for newcomers, offered by banks and community organizations, can help you make informed decisions. Some useful topics include:

- Understanding Interest Rates: Learn how interest is calculated and how to minimize its impact on your finances.

- Recognizing Predatory Practices: Be cautious of payday loans and other high-interest financial products that can trap you in a cycle of debt.

- Budgeting Basics: Creating a budget helps you allocate funds toward debt repayment, savings, and credit-building activities.

FAQs About Credit Building for Immigrants

Q: How long does it take to build a good credit score in Canada?

A: It varies depending on your financial habits, but with consistent, responsible credit usage, you can build a healthy score within six months to a year.

Q: Will opening multiple credit accounts at once help me build credit faster?

A: No. Opening multiple accounts simultaneously can harm your score due to hard inquiries and a shorter average credit history.

Q: What is a “good” credit score in Canada?

A: Scores above 660 are generally considered good, while scores above 750 are excellent.

Conclusion

Establishing a credit history after you immigrate to Canada is a critical step for immigrants, as it opens doors to financial independence and stability. While you may face challenges in transferring your credit score from your home country, programs like Equifax’s Global Consumer Credit File and secured credit cards offer valuable solutions.

By following the strategies outlined in this guide—such as obtaining a SIN, opening a bank account, and using credit responsibly—you can build a strong credit profile and set yourself up for long-term success. Remember, patience and consistency are key in navigating this process.

For more resources and tailored support, consider reaching out to Canadian banks, settlement agencies, or financial advisors to guide you through this journey. Your credit score is not just a number—it’s a gateway to opportunities in your new home.

([Sources: Equifax.ca, RBCRoyalBank.com, Immigration.ca, NerdWallet.ca, MoneySense.ca])

2 Responses