Now that you’ve secured a vacation, it’s essential to go beyond a mere itinerary and packing list. Travel can be costly, necessitating a financial strategy to avoid potential money mishaps that might escalate your expenses.

Related article: Unveiling 5 Travel Hacks On How To Book Cheap Flights

Related article: New Travel Scams To Look Out For On Your Next Trip

Whether it’s mishandling currency exchange at the airport or being unfamiliar with tipping customs at your destination, there are prevalent financial pitfalls travelers often encounter abroad. In this piece we uncover 30 common travel mistakes global travelers make when they go on vacation.

Lack Of A Travel Savings Strategy

Failing to establish a savings strategy for your travels can lead to costly and anxiety-inducing situations. Avoid the expense and stress of spending money upfront and dealing with credit card payments later. Create a personalized savings plan for your travel fund that suits your financial goals.

Crafting a systematic approach to set aside funds for your future travels not only helps prevent unnecessary expenses but also alleviates the stress associated with accumulating credit card debt. Prioritize financial discipline by formulating a travel savings plan that aligns with your individual preferences and circumstances.

A strategy as simple as obtaining a travel savings card or a travel savings app, could be the difference and in so doing, you’ll be better equipped to enjoy your journeys without the burden of post-travel financial strain. Remember, a well-thought-out travel savings plan is a key step toward achieving a more relaxed and enjoyable travel experience.

Limitation In Mobile Data Plans

Overlooking the limitation in mobile data plans can result in substantial charges when using your cellphone abroad. Prior to your departure, explore the international plans offered by your cellphone provider. Alternatively, consider acquiring a prepaid phone upon reaching your destination. One that offers unlimited data mobile plans.

It is crucial to familiarize yourself with the roaming charges associated with using your cell phone abroad. These charges can accumulate quickly and lead to unexpected expenses. Taking the time to understand your provider’s policies on international usage can help you avoid financial surprises during your travels.

Moreover, exploring alternative communication methods, such as local SIM cards or messaging apps that work over Wi-Fi, can be cost-effective options. These alternatives can provide you with connectivity without incurring exorbitant roaming charges. Prioritizing such considerations before embarking on your journey ensures a smoother and more budget-friendly communication experience while abroad.

Failure To Make Currency Exchange Plans

Opting for currency exchange at the airport can be expensive due to the typically elevated exchange rates at airport kiosks. It’s advisable to visit a bank ATM shortly after reaching your destination to obtain local currency at a more favorable rate.

This approach typically ensures more favorable rates, allowing you to secure some local cash without incurring the higher fees associated with airport exchanges. By utilizing a bank ATM shortly after arrival, you can make the most of your currency exchange and have the necessary funds for your immediate needs in the local area.

Inability To Avoid Unnecessary ATM Charges

Incurring avoidable ATM charges is a concern. Your bank may impose steep fees for each withdrawal made in a foreign country. Aim to reduce the frequency of cash withdrawals, and consider opting for a bank and account type that does not levy such fees.

By exercising prudence in managing your transactions, you can minimize the financial implications associated with foreign ATM withdrawals.

Error Of Traveling With More Than One Credit Card

Relying solely on a single credit card is risky. In the realm of technology, you can never predict when issues might arise, and this holds true for credit cards as well. It’s crucial to have a backup credit card available

Investing in the best backup credit card ensures that you are well-prepared for any unforeseen technological glitches or issues that may arise during your travels. Whether it’s a malfunction, loss, or any other unexpected circumstance, having an additional credit card provides a valuable safety net.

Diversifying your payment options not only adds a layer of security but also offers flexibility in case one card is not accepted or faces difficulties. Before embarking on your journey, check with your financial institution to understand the terms and conditions associated with your cards, and make sure to inform them about your travel plans to prevent any potential issues with international transactions.

By taking this precautionary step, you can enjoy your travels with peace of mind, knowing that you have a reliable backup to rely on in case your primary credit card encounters any issues.

Making A Wrong Reward Credit Card Choice

Selecting an inappropriate rewards credit card may lead to undesired outcomes. The potential earnings can vary depending on the specific credit card. It is advisable to opt for a top rewards credit card, one that aligns with your lifestyle and suits your individual preferences.

Consider your spending habits and preferences when making a decision on the most suitable rewards credit card. Evaluating factors such as the card’s annual fee, interest rates, and the types of rewards offered can help you make an informed choice.

Additionally, some cards may provide benefits such as travel perks, cash back, or points that can be redeemed for various goods and services. Before finalizing your choice, take the time to compare different credit cards and their associated terms.

Reading the fine print and understanding the terms and conditions will enable you to make a well-informed decision that aligns with your financial goals and lifestyle. Keep in mind that the right cash rewards credit card can offer valuable benefits, while the wrong choice may result in missed opportunities and unnecessary expenses.

Thinking Travel Insurance Is Not Important

Overlooking the importance of travel insurance is unwise. The uncertainties of a trip, including unexpected incidents or the possibility of requiring medical attention, underscore the necessity of having travel insurance.

Investing in the best travel insurance may ultimately prevent significant financial burdens, making it a crucial component of any travel plan. Thus, it is advisable not to embark on a journey without being travel insured.

When unforeseen circumstances arise during your travels, having comprehensive travel insurance can be a financial safeguard. Whether it’s a sudden illness, trip cancellations, or unexpected expenses, the right insurance coverage can mitigate the impact on your wallet.

Prioritize reviewing the terms and coverage details of different travel insurance plans to ensure they align with your specific needs. Some policies may include medical coverage, trip interruption protection, or coverage for lost belongings.

Taking the time to select a suitable plan tailored to your travel requirements can provide peace of mind and financial security throughout your journey. Remember, the upfront cost of travel insurance is a worthwhile investment compared to the potential financial strain and stress that could arise from unforeseen events during your trip.

Never Forget About Untended Financial Obligations

Disregarding your obligations at home is not advisable. If you plan to be away for several weeks, ensure that you handle your financial commitments prior to your departure to avoid incurring late fees. Explore the option of automating your bill payments to eliminate the need for active consideration.

By overlooking your financial responsibilities at home, you risk facing undesirable consequences. Try streamlining your financial obligations, thus freeing you from the necessity of constant attention to these matters. This proactive approach ensures a smoother and stress-free experience during your time away.

Erroneously Failing To Plan How To Get Around While In A Travel Destination

Lack of awareness about alternative transportation can be problematic. Conduct thorough research on your available transport options in advance. In metropolitan areas, it’s advisable to steer clear of taxis and ride-sharing services, as their costs can accumulate rapidly. Opting for public transportation not only tends to be more cost-effective but can also offer a faster means of travel.

Being uninformed about available transportation alternatives can pose challenges. Familiarizing yourself with these choices enhances your overall travel experience by ensuring efficiency and cost-effectiveness.

Being Unconscious Of Free Services And Travel Pecks

Embarking on a spontaneous journey in search of complimentary offerings. There are numerous methods to savor cost-free experiences while on the go. Whether it’s taking advantage of complimentary guided excursions or accessing museums for free on designated days, be sure to be vigilant about these opportunities before making any ticket purchases.

Additionally, exploring your destination without a set itinerary can lead to unexpected discoveries and hidden gems. Serendipitous encounters with local events, street performances, or community festivals can enhance your travel experience without costing a dime.

Consider tapping into online resources and travel forums where fellow adventurers share tips on finding free activities in various locations. Local parks, nature reserves, and scenic viewpoints often offer breathtaking landscapes and recreational opportunities without the need for admission fees.

Embrace the concept of “traveling like a local” by seeking out community markets, where you can sample local delicacies and experience the vibrant atmosphere without spending extravagantly. Engaging with the local community can provide valuable insights and create lasting memories.

Remember, a flexible approach to your journey not only allows for budget-friendly experiences but also opens the door to unexpected and enriching moments that may not be part of a pre-planned itinerary. So, embrace spontaneity and make the most of the countless free offerings waiting to be discovered during your travels.

The Error Of Traveling Without A Budget

Embarking on a journey without financial planning is a frequent error in travel expenses. This mistake can result in financial setbacks, as you may find yourself covering expenses from your previous trip instead of setting aside funds for your next adventure due to excessive spending.

This oversight can hinder your ability to build a reserve for future travels, as you may find yourself allocating resources to settle debts from your past excursion. It’s essential to prioritize budgeting and financial discipline to ensure that your adventures remain sustainable and don’t compromise your long-term travel goals.

Think about investing in financial planning software, to get you started on optimizing travel costs. By managing your expenses wisely, you can strike a balance between enjoying your current travels and preparing financially for the exciting journeys that lie ahead.

An Oversight Of Not Checking Currency Exchange Rate For A Trip

Lacking comprehension of the currency conversion rate? Simply check the exchange rate for your currency online, and subsequently, you can effortlessly compute expenses mentally while on the move.

Failing to Inform Your Bank And Credit Card Company That You Are Going On A Trip

Failing to notify your bank and credit card provider about your travel plans is a potential oversight. While some banks may necessitate this precaution, others may not. As a precautionary measure, ensure that your bank and credit card companies are aware of your travel destinations to prevent any potential card blocks.

This proactive step will help mitigate the risk of encountering any inconveniences, such as unexpected card freezes or transaction denials, during your travels. Contact your financial institutions in advance and provide them with information about the specific locations and dates of your journey.

This not only safeguards you against potential disruptions to your financial transactions but also enables your bank and credit card companies to monitor and detect any unusual activity, adding an extra layer of security to your accounts.

Remember that communication is key in ensuring a smooth and uninterrupted financial experience while you are away. Taking a few minutes to inform your bank and credit card companies about your travel plans can save you from potential headaches and financial complications down the road. Additionally, inquire about any additional travel-related services or security features that your financial institutions may offer, further enhancing the safety of your financial transactions during your trip.

Choosing The Right Currency At Check-out

Selecting your domestic currency during the check-out process. When making a card payment, you will be presented with the choice of paying in your home currency or the currency of the local area. It is advisable to opt for the latter to avoid higher conversion fees.

Opting for the local currency ensures that you incur lower conversion fees, making your transaction more cost-effective. By choosing the local currency, you bypass additional charges associated with currency conversion, providing you with better value for your purchase. Always prioritize selecting the local currency to optimize your financial savings during the payment process.

Ignoring The Terms And Conditions Regarding Your Luggage

Incurring additional fees for your baggage is a possibility. The terms and conditions related to luggage are explicitly outlined at the time of your flight ticket purchase. Ensure you are familiar with these terms to avoid unexpected charges.

Failing to acquaint yourself with the specified terms may result in unforeseen expenses, particularly in relation to your baggage. It is imperative to thoroughly review the terms and conditions accompanying your flight ticket acquisition to sidestep any potential financial surprises.

Making The Mistake Of Using Your Credit Card To Take Out Money

Utilizing your credit card for cash withdrawals is strongly discouraged. Credit cards impose steep interest rates that begin accruing instantly. Unlike purchases made with a debit card, where interest only accumulates in the subsequent billing cycle.

It doesn’t matter, even if its the best credit card for cash withdrawal, engaging in cash transactions with your credit card can lead to significant financial drawbacks. The elevated interest rates attached to credit card cash advances commence accruing from the moment of withdrawal, resulting in a swift accumulation of additional charges.

In contrast, when you make purchases using your debit card, the accrual of interest is deferred until the subsequent billing cycle, providing a more favorable financial arrangement. It is crucial to exercise caution and opt for alternative payment methods to avoid the adverse consequences associated with credit card cash withdrawals.

Error Of Not Using Deal Sites

Failure to review deal websites could result in missed opportunities. Explore websites that provide excellent offers for your travel destination. You may come across coupons and exclusive deals that allow you to economize on local activities.

It’s crucial to stay updated on the latest promotions and discounts available on these platforms. By neglecting to check these deal sites, you might overlook valuable savings and unique offers that could enhance your overall travel experience.

Keep an eye out for limited-time deals and promotional codes that can significantly reduce the cost of various activities, ensuring you make the most of your budget during your trip.

Not Knowing The Tipping Rule Of Your Intended Destination

Failing to investigate customary tipping norms at your destination is crucial. Tipping expectations vary between nations, with some places anticipating gratuities while others do not endorse the practice. Given that tips typically fall within the 15-20% bracket, being unaware of local tipping customs may result in significant additional expenses.

Overlooking the nuances of tipping etiquette could lead to awkward situations or unintentional cultural misunderstandings. It is essential to familiarize yourself with the specific customs of the region you are visiting to ensure a smooth and respectful interaction with service providers.

In some countries, tipping may be seen as a token of appreciation for excellent service, while in others, it might be considered unnecessary or even inappropriate. Taking the time to grasp these cultural intricacies can enhance your overall travel experience and help you avoid any unintentional social blunders.

Moreover, being informed about local tipping practices demonstrates a respectful and considerate approach towards the local culture. It reflects positively on you as a traveler and can contribute to building positive relationships with the people you encounter during your journey.

Therefore, before embarking on your trip, invest a little time in researching and understanding the tipping norms of your destination to make your travels more enjoyable and culturally sensitive.

Ignoring The Safety Of Your Money And Documents While Abroad

Disregarding the protection of your money and important paperwork is unwise. Both your finances and documents carry significance. It is crucial to consistently prioritize safety, beginning with yourself, followed by your documents, cash, and belongings.

Maintaining a vigilant approach to safeguarding your personal assets is paramount. Be mindful of establishing a security protocol that revolves around prioritizing your well-being, securing essential documents, managing your financial resources, and ensuring the safety of your possessions.

By adhering to this safety hierarchy, you contribute to a comprehensive and effective protection strategy for both you and your valuable belongings. Remember, proactive measures in securing your assets can greatly reduce the risk of unforeseen complications and losses.

Error Of Not Identifying Hidden Charges Before Jetting Off

Lack of awareness regarding concealed charges in advance can be a pitfall, especially when it comes to hotels and airlines, which are renowned for their additional fees. Be mindful of this when outlining your travel budget to steer clear of unexpected and potentially expensive surprises. Ensure that you factor in all possible expenses when budgeting.

Moreover, it is crucial to anticipate potential expenses beyond the apparent costs associated with accommodations and airfare. Unforeseen charges may arise during your journey, such as incidental fees or unexpected service charges.

To enhance your financial preparedness, conduct thorough research on the specific policies of the hotels and airlines you plan to use. This proactive approach will enable you to make more informed decisions and help you avoid any financial setbacks during your travels.

Not Taking Into Account The Cost Of Accommodation On Your Travels

Lack of awareness regarding the living expenses at your intended destination can significantly impact your travel budget. It is essential to familiarize yourself with the cost of living at your destination beforehand. Conduct thorough research on the local economy before embarking on your journey.

This proactive approach will help you make informed financial decisions and avoid unexpected budgetary challenges during your travels. By gaining insights into the economic aspects of your destination, you can plan accordingly, ensuring that your expenses align with the local cost of living.

Take the time to explore factors such as accommodation costs, transportation expenses, and the general price level for goods and services. Armed with this knowledge, you’ll be better equipped to manage your finances effectively and make the most of your travel experience.

Forgetting To Compare Hotel Options

Neglecting to assess lodging alternatives can be an oversight. Opting for a hotel room might be suitable for a single individual or a couple, but it’s worth exploring other options if you have a larger group. Consider, for instance, that choosing a vacation rental could be a more economically prudent decision for bigger groups and families.

it’s essential to factor in the diverse needs and preferences of your group members. A vacation rental often provides more spacious and communal areas, allowing everyone to gather comfortably. This can enhance the overall experience, fostering a sense of togetherness and making the accommodation more enjoyable for larger parties.

Furthermore, vacation rentals frequently come equipped with kitchens and other amenities, providing the flexibility to prepare meals and snacks onsite. This not only adds convenience but can also contribute to significant cost savings compared to dining out for every meal during your stay.

When accommodating a sizable group, exploring alternatives beyond traditional hotel bookings can lead to a more tailored and cost-effective experience, ultimately enhancing the overall quality of your trip.

Avoiding Foreign Transaction Fees

Utilizing a credit card that imposes a foreign transaction fee can result in additional costs, with fees reaching up to three percent for all purchases made in a foreign currency. Fortunately, there are credit cards available that do not charge any fees for transactions in foreign currencies.

Opting for such fee-free credit cards can be advantageous when engaging in international transactions, as it eliminates the burden of extra charges on purchases made abroad. These cards offer a cost-effective solution for those who frequently travel or make purchases in foreign currencies, providing a more economical and convenient financial option. By choosing a credit card without foreign transaction fees, individuals can enjoy the flexibility of global spending without incurring unnecessary additional expenses.

Ignorant Of Your Cyber Vulnerabilities

Employing public Wi-Fi without a VPN exposes you to risks. Even if a password is required to access the Wi-Fi in places like hotels or coffee shops, it remains a public network. Your vulnerability to hacking exists, as anyone with that password can compromise your security. Prioritize the use of a VPN before connecting in such situations.

A VPN, or Virtual Private Network, establishes a secure connection by encrypting your internet traffic. This encryption adds a layer of protection, safeguarding your sensitive information from potential cyber threats and unauthorized access. Therefore, make it a standard practice to activate a VPN before accessing any public Wi-Fi network to ensure your online privacy and security.

Avoid Pricey Airport Lounges

Spending excessively on airport lounge entry may not be ideal. While enjoying the luxury of escaping crowded spaces and unwinding in an airport lounge is appealing, the cost can add up if you haven’t accumulated enough frequent flyer miles to qualify for complimentary access.

Exploring alternative options for accessing airport lounges might be a prudent approach. While the comfort and tranquility offered by these lounges are certainly valuable, the expenses can become burdensome if you haven’t earned enough frequent flyer miles to secure complimentary entry. Consider investigating alternative means of obtaining lounge access to make your airport experience more cost-effective and enjoyable.

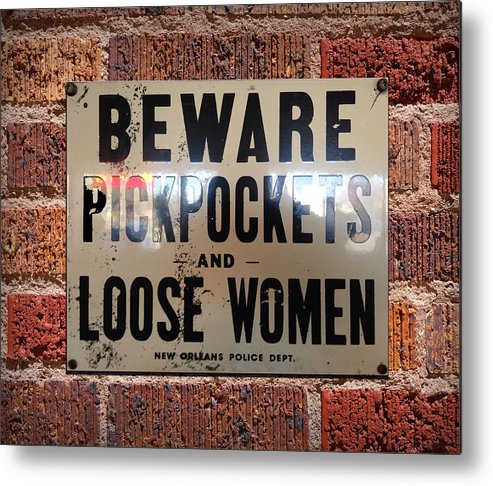

Being Unaware Of Pickpocket Signs

Responding to a warning sign about pickpockets is crucial. If you come across a sign alerting you to the presence of pickpockets in the area, refrain from immediately checking the security of your wallet. Pickpockets often loiter near these signs to observe and discern where individuals tend to store their wallets.

Instead, discreetly ensure the safety of your belongings and be mindful of your surroundings. Proactively safeguarding your possessions without drawing attention to yourself is a key deterrent against potential theft in areas prone to pickpocketing.

Splurging In Grocery Stores While On A Trip

Excessive spending on groceries is a potential pitfall. While the assumption may be that purchasing groceries and preparing meals at your vacation accommodation is a cost-effective option, this isn’t universally true. In certain locations, supermarkets might impose high prices on essential items. Conversely, some destinations offer affordable and excellent dining options that are worth exploring.

Furthermore, it’s essential to be mindful of the local cost of living, as grocery prices can vary significantly from one place to another. It’s not uncommon to find that what seems like a budget-friendly option in one area may turn out to be relatively expensive in another.

Consider exploring the culinary scene at your destination, as some places boast an array of reasonably priced eateries that showcase local flavors and specialties. This not only allows you to experience the authentic taste of the region but can also be a more cost-effective and convenient alternative to preparing every meal yourself.

While the idea of cooking at your vacation rental may initially seem like a money-saving strategy, it’s crucial to research local grocery prices and explore affordable dining options to make informed choices that align with both your budget and culinary preferences.

Be Wary Of Holiday Deals Too Good To Be True

Falling victim to holiday deal scams is a common concern. Occasionally, offers may seem exceptionally enticing. To steer clear of scams, conduct extensive research by reviewing feedback to verify the legitimacy of the company.

It’s crucial to exercise caution when encountering deals that appear overly attractive, as they may conceal hidden risks. Take the time to scrutinize the terms and conditions of the offer and be wary of requests for sensitive personal information or unusual payment methods.

A proactive approach involves seeking out information about the company’s reputation and customer experiences. Utilize online platforms, forums, and social media to gather insights from others who have engaged with the same deals. This collective knowledge can serve as a valuable resource in making an informed decision and avoiding potential pitfalls.

Remember that a genuine and reputable company typically has a transparent online presence, including a legitimate website with clear contact information. If in doubt, reach out to the company directly to confirm the legitimacy of the deal and clarify any uncertainties.

By adopting these precautionary measures, you can safeguard yourself against falling prey to deceptive holiday deals and ensure a more secure and enjoyable shopping experience.

Not Trading Leftover Local Currency

Avoid keeping unused foreign currency. If you happen to possess a substantial sum of money from another country, convert it back to your local currency to prevent it from going unused in your drawer. Utilizing it entirely on souvenirs or duty-free purchases at the airport is equally an imprudent expenditure.

Consider utilizing any remaining foreign currency wisely by exchanging it at a local currency exchange or banking facility. This way, you can maximize the value of the money you have left and avoid unnecessary losses due to fluctuating exchange rates. Additionally, you may want to check if there are any fees associated with currency conversion to make an informed decision.

If you have only a small amount left, you might consider using it for small purchases or as tips during your travels. Some charitable organizations also accept foreign currency donations, so you could contribute to a good cause rather than letting the money go to waste.

In summary, be mindful of your leftover foreign currency and take proactive steps to make the most of it. Whether through strategic exchanges, small purchases, or charitable contributions, there are various ways to ensure that your money serves a purpose rather than sitting idle.

One Response