Most people have searched for how to avoid paying custom duties when entering a country particularly while touring the world. Shopping while traveling is a customary practice. Whether it be clothing, shoes, bags or I.T gadgets, taking back memorabilia that represents the culture of places visited is an age-old tradition. However, in traveling across certain borders whether by car, rail or plane there are usually charges levied on items purchased while visiting cities abroad.

Related Articles: 10 Things You Must Not Do During A U.S Visa Interview

Related Articles: Half Price Train Ticket In The UK: Its Implication For British Rail Travel

The art of collecting duties on items bought abroad is a norm that transcends time. This practice has been in place for centuries. A subset of travelers have been able to find a way to bend this rule in their favor. By simply understanding how to go about it the right way, in order to be on the right side of the law.

In this article, I will show you how you can go about this. And it is my desire that by the time you are done reading this piece, you should be able to legally avoid paying custom duties when traveling between countries

Custom Duties

The economics times defines a custom duty as a tax imposed on import or export of goods. Meaning charge levied on goods coming in or going out of a country. The amount charged for duties are either fixed per category or in a proportion to be estimated by the value of the goods concerned.

Custom duty could be as low as 0% for certain locations such as Hong Kong and Macau to countries that offer percentage rates as high as 34.63% for countries like Palau. According to Rule 3(i) of the Customs Valuation (Resolution of Value of Imported Goods) Rules, 2007 holds that the value of imported goods shall be the transaction value adjusted in accordance with the provisions of Rule 10.

How Are Custom Duties Levied?

It is possible that objective and measurable data might not exist thus making factors for valuation difficult or in some cases impossible. If conditions for valuation are not followed or if authorities administering the functions of customs are unsure about the precision or accuracy the declared value as stipulated in Rule 12 of the said Valuation Rules, 2007.

Then valuation, will have to be carried out by other methods in order of hierarchy. Such as; comparing transactional value of identical goods (comparative value method (Rule 4)), a comparison could also be made with market value of similar goods (Rule 5), a deduction could be made in accordance with sales price of said goods in country of import (Rule 7).

If the above methods fail and valuation is still inconclusive, then an extrapolation of cost related to raw materials used in goods manufacture, processing and profit realization in production country would be considered (Rule 8). Under Rule 9; there is allowance for flexibility in the valuation process.

How To Legally Avoid Paying Custom Duty

Even though there are different types of custom duties payable when exiting or entering a country, barring countries that are duty free. There is only one way which is legally accepted which shows you how to avoid paying custom duties when entering a country.

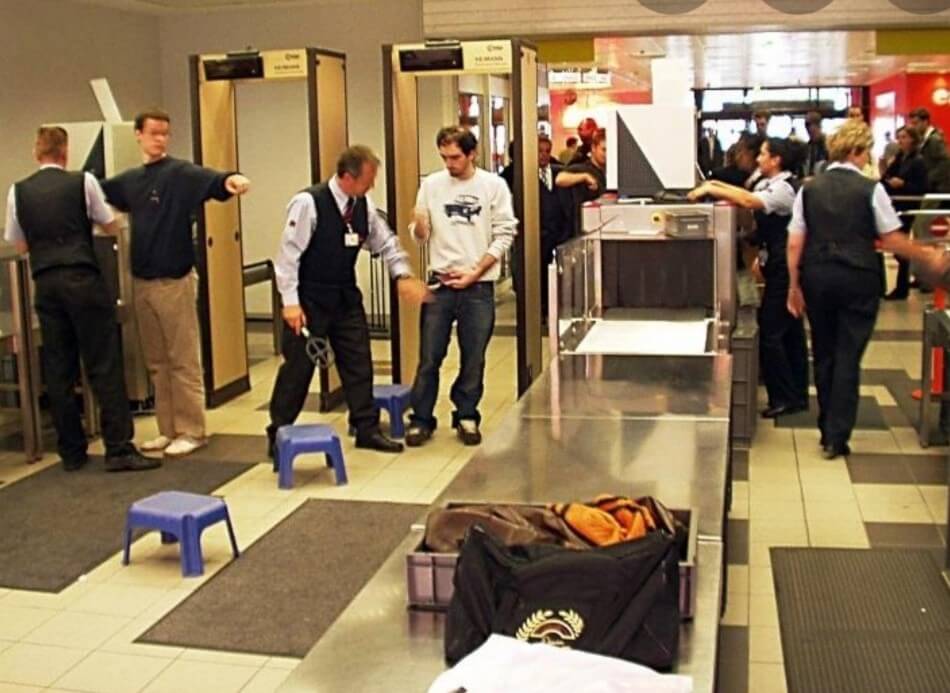

This is usually done by unwrapping whatever item/items purchased on one’s travels, stripping these goods and getting rid of the branded casing obtained from the store when this product was originally procured.

Say for example 6 units of an iPhone 11 pro max was purchased by a tourist in the United States, before departure from the U.S, irrespective of whatever country which could be the next destination of the traveler. By simply getting rid of the iPhone’s branded casing that houses the phone as well as the accompanying leaflet and other wrappings would eliminate the need to pay duty at any custom checkpoint.

As even though the phones are seen when the luggage is searched, they are assumed to be privately owned phones belonging to the traveler and so cannot be charged any form of tariff. This applies to all goods from laptops, clothes, shoes to other hardware. As long as they can be unwrapped and packed with other personal effects in a luggage, they are seen as private property.

This rule is not restricted to one country. This is the practice the world over and is usually seen as too easy a solution, which is probably why most people tend to overlook it and end up paying exorbitant amounts in custom duties.

It is worth stating that if you decide to buy a massive quantity of a particular product, for instance iPads, and house them in a separate luggage, even though they are stripped of their branded packaging, the custom authority will perceive this to mean that you are trying to game the system and higher sanctions might accrue.

We frequently come out with travel hacks such as this, you might want to subscribe to our newsletter to receive regular tips on how to save cost while traveling.